However, the chart of accounts plays a critical role in how your revenue accounts, for instance, flow into the profit and loss statement. That’s what your company faces without a well-organized chart of accounts. It’s like wandering through a complex and sprawling city in search of a financial needle in a haystack.

Wholesale business

There’s no maximum or minimum number of accounts that should be included in a chart of accounts. Ultimately, how many accounts you choose to include reflects the size and complexity of the business. You can find more detailed instructions on how to use our sample chart understanding your paycheck withholdings of accounts when you download this template. Asset accounts can be confusing because they not only track what you paid for each asset, but they also follow processes like depreciation. For each category (i.e. revenue, COGS, OPEX) designate a starting number.

Blue chips to boutiques. Energy to Entertainment. Whatever your industry, we have the know-how.

It also doesn’t apply benefits near each other, so it’s hard to see your total people costs in one place. Imagine someone plops you down into the middle of a massive city and asks you to find a particular address. Even if you know that city fairly well, without a GPS or map to direct you, you’re either going to spend an awfully long time finding that address or not find it at all. Income tends to be the category that business owners underutilise the most. We provide third-party links as a convenience and for informational purposes only.

Can this chart of accounts template be used in Google Sheets?

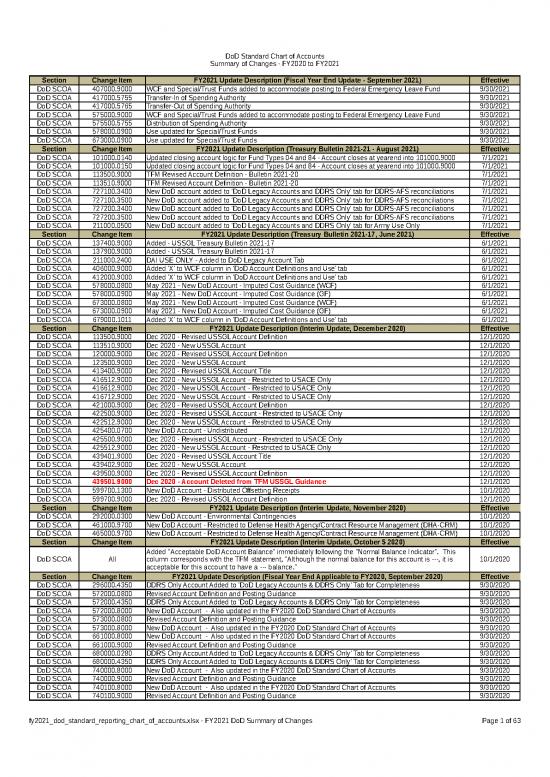

Numbering conventions differ between businesses but generally follow a series running from 100–599 or 1000–5999. Revenues show up on these businesses’ profit and loss statements, also called income statements. Current asset accounts are those you expect to convert to cash within a year, whereas non-current assets are expected to be converted to cash in a year or more.

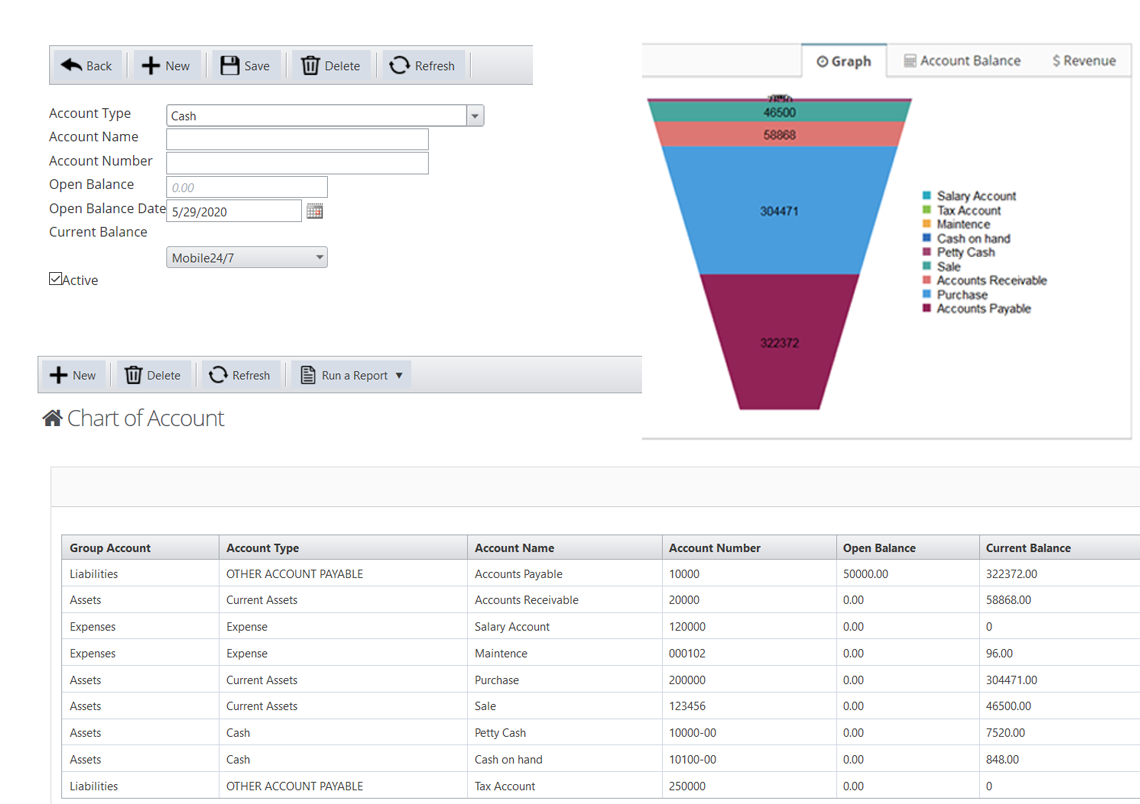

Asset accounts represent everything your business owns, from cash and accounts receivable (money owed to you) to inventory and fixed assets like property and equipment. These accounts are crucial for understanding the resources available to your company and assessing its financial stability. As businesses grow and financial transactions become more complex, one key tool to overcome these challenges is a well-organized chart of accounts (COA). Granted, by the time they hit your financial reports, you’re probably grouping them in a line item anyway.

- The purpose of the sub-group is to categorize each account into classifications that you might need to present the balance sheet and income statement in accounting reports.

- On one hand, keeping the number of accounts to a minimum will make the accounting system more straightforward to use.

- We suggest proceeding with caution with your adjustments, however, as you want to make sure you are consistent and logical.

- If you start off with only a handful of accounts and then keep expanding the list as your business grows, it may become increasingly challenging to compare financial results against the previous years.

- After your review, make sure you have all the accounts you need to suit your existing needs.

- Think of your chart of accounts as a roadmap across your operations, indexing all of your different financial accounts in an organized, consumable way.

Typically, businesses use a standard set of categories, such as assets, liabilities, equity, income, and expenses. Because the chart of accounts is a list of every account found in the business’s accounting system, it can provide insight into all of the different financial transactions that take place within the company. It helps to categorize all transactions, working as a simple, at-a-glance reference point. Business owners who keep a chart of accounts handy will have an advantage when it comes to accounting. If you’ve worked on a general ledger before, you’ll notice the accounts for the ledger are the same as the ones found in a chart of accounts.Keeping your books organized does not need to be a chore.

In this chart of accounts for small business, the code is a number, but could be any appropriate system which allows accounts to be grouped together. For example, all the cash accounts have numbers in the range 1000 to 1999. It is normally better to use numbers for account codes as this speeds up the entering of double entry bookkeeping transactions using the numeric key pad on a typical computer keyboard. As businesses grow, managing financial transactions can become increasingly complex. A chart of accounts (COA) is a fundamental tool that simplifies the process by helping to organize transactions and track financial performance. In the comprehensive guide, we’ll discuss the definition, importance, and examples of a chart of accounts.

You capture this sort of loss in the non-operating category to separate it from typical operating expenses. These accounts capture the income generated from your core business activities, the lifeblood of your company. Sales of products, services rendered, commissions earned—all these fall under revenue. Remember, this section focuses solely on income directly tied to your central operations. These accounts equate to the equity value remaining in your business after deducting your liabilities from your assets.